I received this mail from Chase recently

They previously offered just $150 for new customer accounts, are they getting more desperate?

Or perhaps just more discriminatory? The small print on the back requires a minimum deposit of $15,000 and a minimum balance of $15,000 for 90 days, and the account must be open for 6 months. Clearly they aren’t looking for low-end customers.

To put their offer in perspective, if I ONLY created a new account and left my $15,000 in there for 90 days to get the $200, and then closed my account after 6 months, I would be receiving about a 2.5% return. Meh. I can do better.

A reader sent this in:

Tampa, FL, Chase campus is expecting large crowds of picketers on May 15, 2012, to protest onsite at the Annual Shareholders Meeting where the big money-making executives are scheduled to be present.

The PDF for this event is available at www.Shareholder.com

or simply Google this phrase “site:shareholder.com 2012 chase shareholder meeting tampa”

Employees are being encourages to stay home on May 15, 2012, in light of the heightened security for this three-building campus at 10430 Highland Manor Drive, 33610

I can’t vouch for any of the information but if past big bank (including Chase) annual shareholder meetings are any guide, protests are likely.

Chase CEO Jamie Dimon recently complained that the New York Times hates banks. There is some good evidence that it isn’t just the New York Times, or media in general that hates banks, but pretty much everyone on the US. Furthermore, Chase in particular seems to have people’s ire, and a Harris Interactive poll found them to have the 9th worse corporate reputation in America.

A company’s reputation is formed not only by the products it sells, but by the decisions it makes in times of crises. For some, that’s a good thing. For others, some present on this list, not so much.

Using survey results, market research firm Harris Interactive has compiled a list of the U.S. companies with the best and worst reputations. For the 12th Annual Harris Interactive U.S. Reputation Quotient Survey roughly 30,000 Americans were asked to rate the 60 most visible companies in the United States based on six factors: financial performance, products and services, workplace environment, vision and leadership, social responsibility, and emotional appeal. Combining these factors, Harris tallied a total RQ Score. Scoring above 80, for reference, indicates a company’s reputation is “excellent.”

Overall, companies in this year’s survey ranked higher than the previous year, with 16 companies rated as “excellent” compared to only six last year. Tech companies, in general, seem to have the best reputations, while financial and oil companies have the worst. Notorious scandals like the BP Gulf Oil Spill and Goldman Sachs’s role in the subprime crisis seem to have lingered in American minds, and companies with the worst reputations scored especially poorly when rated on whether they have “high ethical standards” and could be “trusted to do the right thing.”

Car companies largely fell somewhere in the middle, but that could change in the coming years. General Motors and Chrysler, while stuck in the bottom 11 this year, did make the third and fourth highest gains on the list, respectively, of any company.

Below are the 11 companies with the worst corporate reputations:

9. JPMorgan Chase

In a seriously funny turn of events, the USPTO just awarded Washington Mutual a patent on a system to automatically transfer information from an old account to a new account and take into account common kinks that can happen along the way.

Chase sure could have use this system when they took over all the WaMu account with all the problems people encountered.

I trust everyone had a great Bank Transfer Day, which was yesterday.

Apparently the biggest boon to credit unions this year has been the attempt by big banks (all but abandoned now) to institute a debit card usage fee. According to NPR Marketplace, credit unions have seen more new customer accounts opened in the last six weeks than they do in a typical year.

Congratulations on those of you who finally realized the big banks don’t care about you.

The urban dictionary has an interesting definition for WaMu. They probably should have checked before going with “WaMu.” 🙂

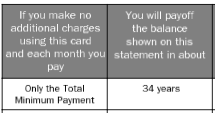

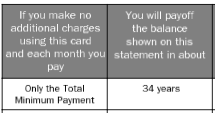

This is from my very own credit card statement.

In what reasonable sense of business does a credit card company allow someone to pay such a small amount each month that it would take 34 years to pay off their balance? If you’ve seen The Secret History of the Credit Card (PBS Frontline) you know why this makes business sense; banks make way more than just interest off of customers that pay only the (extremely undersized) minimum payment, in the form of late fees, much higher rates, and the like.

So, the next time you hear of a bank complaining about customers not being responsible and paying off their credit cards, remember the credit pushers that got the customer hooked in the first place.

I pay off my bill in full every month by the way. 🙂