If you were a shareholder of Washington Mutual between 2005 and 2008 you might be interested to know that a lawsuit against former WaMu officers, directors, underwriters, and auditors has just been granted class-action status. You can find more information here.

We reported a couple of months ago that the sale of Washington Mutual to JPMorgan Chase had not actually officially closed, leaving some speculation that the FDIC might have an opportunity to force JPMorgan Chase to pay more, given how the value of the assets has been proven more valuable than originally estimated.

Since then, JPMorgan Chase has actually turned the tables and asked the FDIC for money back, more than they actually paid for WaMu.

Well, the deal was supposed to be closed by September 30, and the close has been extended another 30 days.

Perhaps JPMorgan Chase requested money from the FDIC to cover lawsuits related to WaMu as a counter offensive against the FDIC asking for more money for the WaMu deal, hoping for a wash.

I realize none of the favorable outcomes we are speculating on are likely, but we can at least hope for justice, can’t we?

In the last days before WaMu was seized and sold to JP Morgan Chase in what turned out to be an immensely profitable deal for Chase, Washington Mutual executives sent a series of letters to the FDIC trying to convince them that WaMu was sufficiently capitalized and did not need intervention.

WaMu’s outflow of deposits had “moderated substantially” following the September 2008 collapse of Lehman Brothers, wrote CEO Alan Fishman and Chairman Stephen Frank in the September 24, 2008, letter to regulators. One day later, regulators took down WaMu and sold its banking operations to J.P. Morgan for $1.88 billion.

What’s more, the thrift had a plan to create $19 billion more in capital “without a penny of government assistance.”

The letter, WaMu’s last hope of survival after it failed to secure a buyer on its own, was addressed to Federal Reserve Vice Chairman Donald Kohn, Federal Deposit Insurance Corporation Chair Sheila Bair and OTS director John Reich.

The document includes a plea for leniency. A seizure “of a large, well-capitalized U.S. banking organization,” Mr. Fishman and Mr. Frank wrote, “is without precedent in U.S. history and will send a stark message to bank customers and investors. We think there is no reason to take such a dramatic step when our proposal would, quickly and simply, create $19 billion more capital for WaMu and reposition it to easily withstand the current market turmoil – all without a penny of government assistance.”

Read the entire story at WSJ.com

There appears to be some significant reason for doubt that Washington Mutual would have failed if intervention by the FDIC had not occurred.

It looks like WaMu shareholders might actually be getting their moneys worth out of the WaMu bankruptcy examiner, former head of the Justice Department fraud unit Joshua Hochberg.

Hochberg has asked for more time to complete his investigation and will be submitting a final report on Nov 1st.

Specific areas he is investigating include:

- whether New York- based JPMorgan “intentionally injured” WaMu so it could purchase the bank subsidiary at a lower price.

- whether JPMorgan intentionally interfered with possible purchases of the bank by other buyers

- ownership of $4 billion in deposit accounts at the bank and whether the holding company has any claims for $6.5 billion in capital contributions made to the bank from December 2007 to September 2008

- who should end up with billions of dollars in tax refunds and whether trust preferred securities were properly exchanged for equity

With many of the stories we get about the way Chase bank treats its customers, it is a toss-up as to whether Chase does the things it does because they don’t have a clue or whether they really have a master plan that is all about sucking the most money out of their customers in whatever way possible, ethical or not. If they really do have a master plan, disguising it in a veil of ineptitude is a stroke of genius.

This recent story about the deal Chase struck with Fannie Mae & Freddie Mac in early 2009 related to their purchase of WaMu mortgages has me leaning towards the master plan theory. Here is an excerpt from the story:

Yet J.P. Morgan seems better-positioned than rivals for repurchases. That could have a lot to do with a deal it forged with government-backed mortgage buyers last year. In September 2008, J.P. Morgan bought certain assets and liabilities of failed Washington Mutual Bank. Then, in the first quarter of 2009, J.P. Morgan cut a deal with the government agencies that “resolved certain current and future” repurchase claims stemming from WaMu mortgages. It isn’t clear how many loans were involved and what the settlement cost. In 2010, a J.P. Morgan filing merely said a $714 million hit in the 2009 first quarter was “primarily related” to the deal.

But it looks like money well spent. The WaMu repurchase exposure could have been particularly nasty. The bank wrote about $490 billion of mortgages from 2005 through the middle of 2008, and appeared to sell well over half of them. What is more, WaMu specialized in option-adjustable-rate mortgages, which showed high losses and appear to be more vulnerable to repurchase demands.

In this case they clearly showed that they are thinking things through ahead of time, which would seem to indicate that the way they treat their customers, from delayed loan modifications to lowered credit lines and increased minimum payments is more of a plan than anything else.

But that is just my theory.

From a reader this morning:

Was just wondering if you’ve heard of anything weird about this.

I was a Wamu customer before the changeover. Was in my local Chase branch about 2 months ago and the teller told me that my old Wamu debit card was about to stop working. The expiration isn’t until 2011, so I questioned her and she said all Wamu debit cards are about to be turned off and I should order a new Chase debit card.

I didn’t think much about it until I was in the branch again about 2 weeks ago. I asked one of the CSRs about it and he said yes, those “old wamu” cards were scheduled to be turned off “any minute.” He was surprised mine worked at all and said mine was probably one of the last ones still working.

I have never received any official notice from Chase about this, only words from the people in this one branch.

Well, I had him order me a new debit card and I asked if it would be the same card number. He said “no” because they would be switching from Mastercard to Visa.

Fast forward a week or so and my new card arrives. It’s a Mastercard just like my “old” wamu card, but with a new number. The thing is, my old wamu card still works fine. I haven’t activated the new card yet.

I’m wondering why the hard push to get me into a new Chase branded card? Any thoughts?

Anyone had their card stop working without any notification?

Probably the best coverage of the WaMu failure has come not surprisingly from Washington Mutual’s home town of Seattle and the Puget Sound Business Journal. Their most recent articles have helped publicize the fact that the JP Morgan Chase purchase of WaMu’s assets isn’t actually closed yet, leaving the door for the FDIC to insist they pay more.

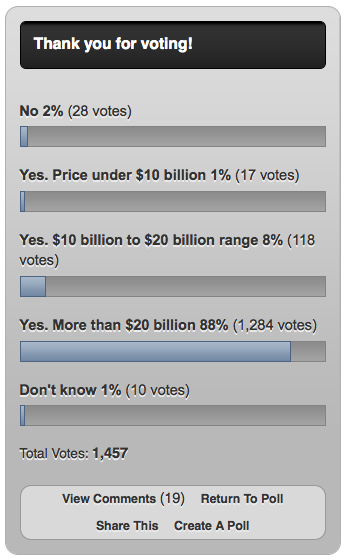

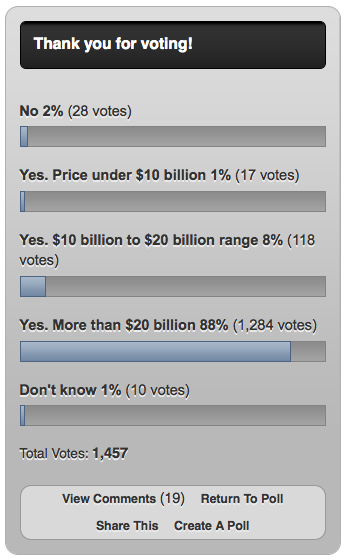

Their latest offering is a poll where they ask people whether JP Morgan Chase should pay more than the $1.9 billion they paid for WaMu. I’d say the results indicate people overwhelmingly say yes, although it is still pretty early in the poll’s results.

Interestingly enough, most of the news the BizJournal prints about WaMu and Chase is not favorable of Chase. It is surprising to me that the banner ads on the BizJournal’s articles are Chase ads. Rather karmic perhaps.

We reported yesterday that according to documents recently uncovered, the purchase of Washington Mutual’s assets by Chase hasn’t officially closed yet.

Today, the Wall Street Journal is suggesting that, almost two years later, and with a better idea of the true value of WaMu’s assets (i.e. much greater than what Chase paid for them), the FDIC might be pressured into increasing the price JP Morgan Chase must pay. Shareholders, who got severely shafted by the seizure and sale, are obviously the greatest beneficiaries if this were to happen, but everyone’s sense of fairness and justice might just benefit as well.