A class action lawsuit has been filed against Chase Home Finance LLC and JPMorgan Chase, N.A. in the U.S. District Court, Southern District of California, alleging that defendants reneged on a promise to modify troubled mortgages. The class action is brought on behalf of the following class of persons:

All mortgagors in the the State of California whose home mortgage loans are or were serviced by Chase Home Finance LLC or JPMorgan Chase Bank, N.A. and who (a) have attempted to obtain permanent loan modifications from Chase Home Finance LLC or JP Morgan Chase Bank, N.A. through the Home Affordable Modification Program (“HAMP”) or similiar loan modification programs; and (b) have made payments pursuant to a HAMP Trial Period Plan (“TPP”) or any similiar temporary modification agreement offered by Defendants.

For more information on the Chase Home Finance & JPMorgan Chase mortgage loan modification class action lawsuit, read the Chase Home Finance & JPMorgan Chase class action lawsuit complaint.

For information about this class action, contact paralegal Nick Wallace or attorneys Gretchen Obrist or Lynn Sarko at 800.776.6044 or via email at info@kellerrohrback.com.

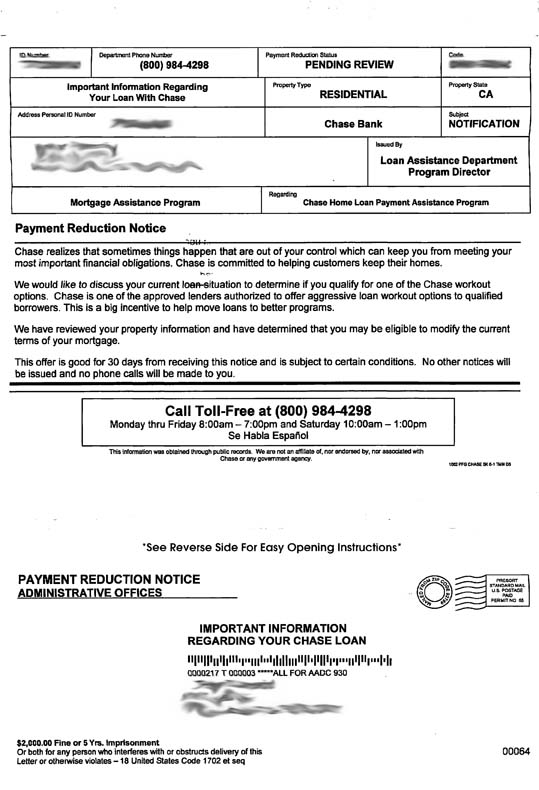

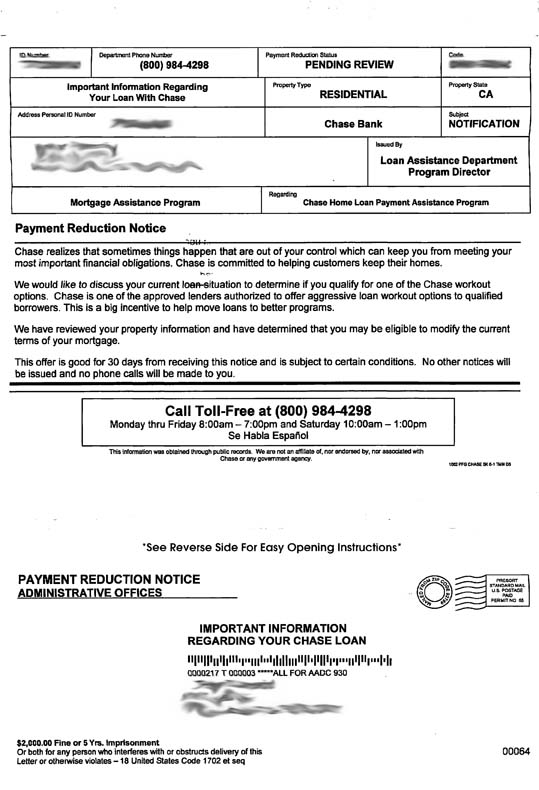

I’ve never had a Chase mortgage (thank God), and not underwater on my current mortgage, but still received this Chase loan modification notice in the mail.

If you look closely the fine print on the bottom indicates that this isn’t from Chase, but from some other bottom-feeding company that will no-doubt offer to obtain a loan modification from Chase … for a fee.

Please don’t be fooled by offers like this. The economic meltdown and the large number of people having trouble with their loans has bred a cottage industry of companies that exist only to scan people.

There has been a lot of speculation as to exactly how much documentation Chase (and other banks) have lost on the original mortgages and subsequent ownership transfers that have created a legal quagmire (and liability) they are experiencing with proving authority to foreclose.

Well, hints come from many places and today’s comes courtesy of a commentor on our blog:

I just had a Chase representative tell me that I had to send in a copy of my recorded mortgage or they wouldn’t process my HAMP request. I’m not about to hand them documents that they would just use to take my house! This company is something…

A wise choice indeed. Don’t give Chase documentation they may have lost and without which they can’t foreclose on you. Be wary of signing anything that reaffirms their ownership of your mortgage or authority over it (if they are only the servicer, not the owner) if they can’t otherwise prove it. Better yet, ask them for proof of their authority over your loan before agreeing to anything. If they can’t provide it, ask them for better terms to your loan modification.

Yes, I realize these are very simple and potentially naive suggestions, but the truth is that no-one knows what might work given the documentation uncertainty the banks have today. One thing that is sure, they know they have a problem.

We received this note from a reader:

Hagens Berman 206-623-7292 may be involved in a class action lawsuit on behalf of Chase customers who have been attempting to modify their mortgage loans.

From their website, I was able to find this case that involves several large banks (presumably including Chase) not providing loan modifications to eligible customers.

JPMorgan Names New Head for Mortgage Business

By ERIC DASH

Hoping to troubleshoot some of the problems plaguing its mortgage operations, Jamie Dimon on Friday dispatched one of his top lieutenants to oversee the Chase Home Lending business.

Frank Bisignano, JPMorgan Chase’s chief administrative officer, will now add supervising the Chase’s mortgage origination and loan payment collection businesses to his duties managing many activities, like technology and real estate, for the bank. David Lowman, the current head of Chase Home Lending, will retain his title but now report to Mr. Bisignano.

Read more …

Many times over the last year lawmakers and attorneys general, and even the White House have talked about how screwed up and unsuccessful the loan modification process has been, but that doesn’t seem to have changed Chase’s convoluted approach, if this story is any indication.

I have been experiencing all of the same frustrating experiences as many of your bloggers for the past 18 months. The long and the short of it is that, after over a year of providing multiple packets of requested documentation (at least 10 different times because either they never received what I sent, or because it took them so long to finally look at what I sent them that they needed updated docs, only to repeat the same delays and request for updated docs again), and while making agreed to reduced payments under a forbearance agreement, on July 16, 2010, I finally received a verbal approval over the telephone of a modification, approved on July 14, 2010.. ( I have the names of the 2 individuals I received this info from, and their phone numbers and extensions. Its my guess however that either they no longer work for chase and/or most likely their numbers and extensions have changed many times since then). I was told the exact terms of the modification and when the new payments would begin (Sept 1, 2010). I was told I would receive the packet in 7-10 days. After many calls requesting the modification package during the next 30 days, I still had not received it. Yet I was told in every instance of calling inquiring about the where abouts of the packet, that my file shows that iI had been approved on July 14, 2010 and the docs were coming.

As a homebuilder in Dallas, my business at this point has been relegated to remodeling and my income significantly reduced. I had foreclosures last year, and resulting deficiencies against me for a couple of houses I had built and couldnt sell for what I owed. I was forced into bankruptcy before ever receiving the modification package (which I never did actually receive) and chase then pulled the modification. I re-affirmed my mortgage with chase and have communicated to them that I am still ready, willing and able to commence payments in accordance to the terms of the modification that I was approved for. I have since been contacted by an attorney for chase (initially, 3 months ago, out of Houston), inquiring of my intentions. I have told her the story and that I still was willing to go with the mod terms. She said she would get with chase and just get this mod done.. Nothing has been accomplished since. Most of my calls and emails to her have gone unanswered and when I have been able to reach her, her response has always been that she has not heard back from chase. So, for over 3 months, an attorneys client has not responded to their lawyer regarding resolving a legal matter.

We received this story from a reader today:

There is so much to say. We were on a 3 month trail agreement that went to 14 months I was calling, faxing, leaving messages. I always called the Loss Mitigation dept. They said just keep on making ur payments ok this past Aug 2010 We did a phone financial & I did fax all the infor. the same day too. Just keep on making ur payments if we need any thing we will call u. So I went into chase to make our Dec. 1 2010 modification payment they would not take it 🙁 it is SUSPENDED in FORECLOSURE!!!! What? I ask chase to call for me!! They told me that. WHAT the HELL chase did not call me fax me email fed ex me nothing. I was told Mr. Vahe said that Laurel Lindsey got my case after 14 months on this trial modification we were paying on time calling all the time, where is our permanent workout solution for our loan cause the trial has been completed + ? O This Laurel Lindsey only had our case for 5 DAYS, now there saying we have been 19 months past due What? we were on a mod. & b for that we had to FILE BANKRUPTCY for a modification we had to much debt. I will be back…… Please help me help

Oh Chase, how long can you hope to continue to get away with such a twisted loan modification process before Congress slams you with new regulations?

Long story short, 19 months ago I filed for a loan modification after I lost my job. Chase has lied to me, missed countless deadlines, lost fax after fax with bank account and social security numbers, not returned phone calls and their credit dept. has harrassed the living shit out of me. I have written letters to the NYS Attorney General, Comptroller of Currency, local newspaper complaining of the unethical way which Chase has conducted their business. A few weeks ago they tell me I am approved and foolishly, I get excited about what should be good news after all of this BS.

Incredibly, they make an offer to me that is $83.00 more per month than when I started this fiasco. My pay has been reduced by almost $25k and somehow Chase offers me a higher mortgage to “help me out”.

And the icing on the cake is that they gave me a “temporary” loan mod over a year ago until this was settled. The money I was saving during this period ($650/mo.) was reported as a shortfall by Chase and reported to the credit agencies as such. They single-handedly dropped my credit rating by over 150 points so it is almost impossible to explore any other options.

CHASE HOME MORTGAGE SUCKS!!!!!!!!

I guess this customer should be lucky that Chase didn’t demand all the savings during the loan modification period in a lump sum like they have done with plenty other customers and foreclose if the customer didn’t pay.