I am not going to argue that the person who wrote this complaint is the most articulate and logical person in the world, but their point is a frequent one with Chase; Many of the people at Chase simply don’t know what they are talking about and often make up arbitrary rules.

In this case, the customer went into a Chase branch to get $27,000 in cashiers checks, and because he has some concern about the party he was about to do the transaction with, he asked to speak with the branch manager (but was given the assistant branch manager) and specifically asked what needed to be done if he wanted to cancel the cashiers checks. The (assistant) branch manager told him with authority that he need simply bring in the check stubs and they could invalidate them.

As it turns out, his concern about the other party were correct and he want to the branch to cancel the cashiers checks. He was told to take a hike.

Now, canceling cashiers checks in the fashion sounds like something that wouldn’t be allowed, but why then would the (assistant) branch manager tell him that?

Wow, this is a big screw up on Chase’s part and shows just how badly Chase screwed up some things when they transitioned WaMu customers over to their bank. In essence, the customer had a mortgage with WaMu since 2003 and never missed a payment or was late. All of a sudden she received a letter in the mail saying they are being foreclosed upon. WTF?

Turns out that Chase, in response to a small lapse in the homeowners insurance, added an escrow account for insurance onto her loan that added additional payment. But they somehow forgot to notify her of it. When checks came in, they noticed that the check amount didn’t equal the newly increased due amount, so they put all the payments into a “suspend fund” and the payments were not applied to her mortgage. Again, they failed to notify her that this was happening.

So many of the problems with Chase seem to do with their lack of notifying customers of essential information.

Ok, this is complete hearsay, but it is such a dramatic story (from this post) it is worth passing on.

When I called my local insurance office and explained what I needed and why, the young women there told me that her grandmother had a LARGE amount of money deposited with CHASE and it was six figures. They LOST her money!! She asked them what happened to it and they told her to prove she had the money with them!! OMG!! She said it took her grandmother an attorney and months to resolve that issue and CHASE finally FOUND her grandmothers money!!

Another complaint related to Chase’s electronic banking features:

I made the account auto pay in Dec/2009 was hospitalized Jan checked acct Feb/2010 found it unpaid caught it up.

Again made it auto pay in Feb/2010 (via internet only option) again received a success notice upon completion. Started a new job continued recovery lost track of my life, received no notices from Chase that there was any problem, no e-mail, no phone calls and no mail.

After finishing my teaching job checked acct and found it was 60 days late. Upon calling company was told my acct had been closed and reported to credit reporting my only option was to make payments, nothing else could be done. This after paying it with all the penalties plus being a good customer for 5 years, paying card off multiple times and very seldom carrying a large balance.

These are pretty basic things. To have them fail like this repeatedly would give me zero confidence in anything Chase does related to e-banking.

For nine months and three buyers Lauren Moughon tried to close a short sale on her house in Washington. She had to give them the same documents over and over again. Finally she called the local TV news station consumer advocate, who called Chase, and they immediately pulled their head out of wherever it was and closed the deal.

Is that really the only thing that will make Chase respond?

Thanks to this article about Chase adding texting features to their account balance alert service, I now understand why their balance alerts are useless; they aren’t sent out until the end of the day.

Think about this for a second. Something happens during the day, presumably unexpected, which pulls your account balance below and amount that you want to know about. If this happens early in the day, lots of other things can happen before you find out about it. By the time you get the alert, it may very well be too late.

Kinda worthless. But I think Chase knows this. If they told you in a timely fashion that a problem might occur, they might not make as much in fees.

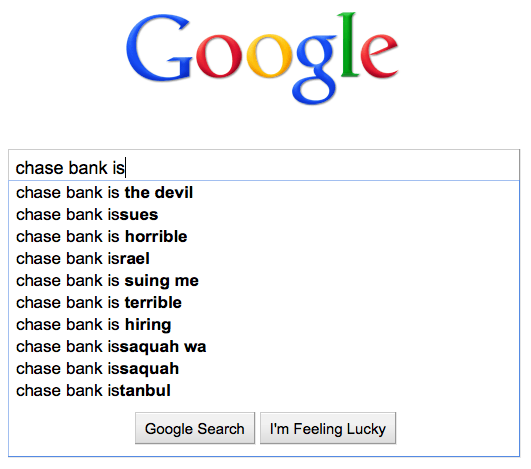

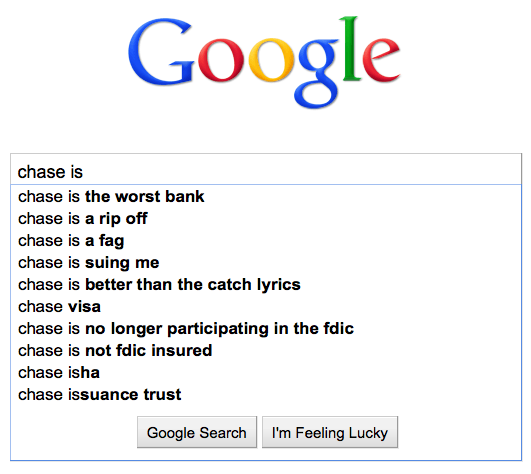

Google search offers suggestions when you start entering search terms that are based on the most popular terms others have searched on that match what you are typing. Clearly, from what Google suggests, people are not happy with Chase.

Here is a humorous story about a guy just trying to activate his new Chase ATM card that he received in the mail. What should have been a simple procedure had Chase thought it through turned into a major hassle that involved a half-dozen Chase employees.