If you pay a mortgage, or any type of loan payment for that matter, you know, there is the due date, and the date after which a payment is considered late. For instance, my mortgage is due on the 1st of each month, but isn’t considered late until after the 16th.

I often pay after the 1st of the month (but before the 16th) and have never heard a complaint from my bank about this. After all, why would I, the payment isn’t late.

Why then is Chase harassing this customer with daily phone calls after the 1st but before the payment is actually due later in the month? Can they not figure out their own late payment date?

My wife and I have been sad Mortgage holders with Chase by accident.. We had a WAMU mortgage back in 96 that was transfered after the big mess and failure of WAMU. We have never been late with them, just on time before they could sick fees on us. The mortage is due on the 1st of course but the late fee is not assessed until the 16th. We purposely setup auto transfer of our payment for the 14th of the month before the payment is considered late. They seem to think that we need to be reminded every day after the 1st that our payment is due. We remind them that it is not late and no late fee is due. We pay the stupid mortgage unlike some of our friends and neighbors albeit just in time every month.. They seem to think that having some one call every day at least once literally to remind us starting on the 1st or the 2nd is appropriate and good business behavior. Even telling them we have it set up on the 14th does not work. They will call several times a day. Sadly I believe we will find some reason to sue them or do a strategic default since even paying the mortgage is not good enough for them. The people that call have meager english skills also and i believe my 5 year old could do better at calling people.

Point is Chase is obnoxious and even our second loan Ocwen does not even harass us.. Sad is that even Ocwen is smart enough to leave us alone since we pay consistently but Chase is not. If we default we will pay Ocwen and screw Chase if we can… Sad to say we will need to turn off the home phone or change our number because of Chase even though we are not deadbeats, work our asses off to fulfill the foolish committment we made while watching our neighbors buy new cars, take nice trips and not have to pay rent or mortgage for over a year.. Chase sucks and deserves some more bad loans….

Update: Here is another report of this same thing. Seriously, what are they trying to accomplish? I think this could be a great opportunity to mess with the Chase customer service people, like, “Hold on a sec” and then just set the phone down, or do some telemarketer pranks like comedian Jim Florentine does.

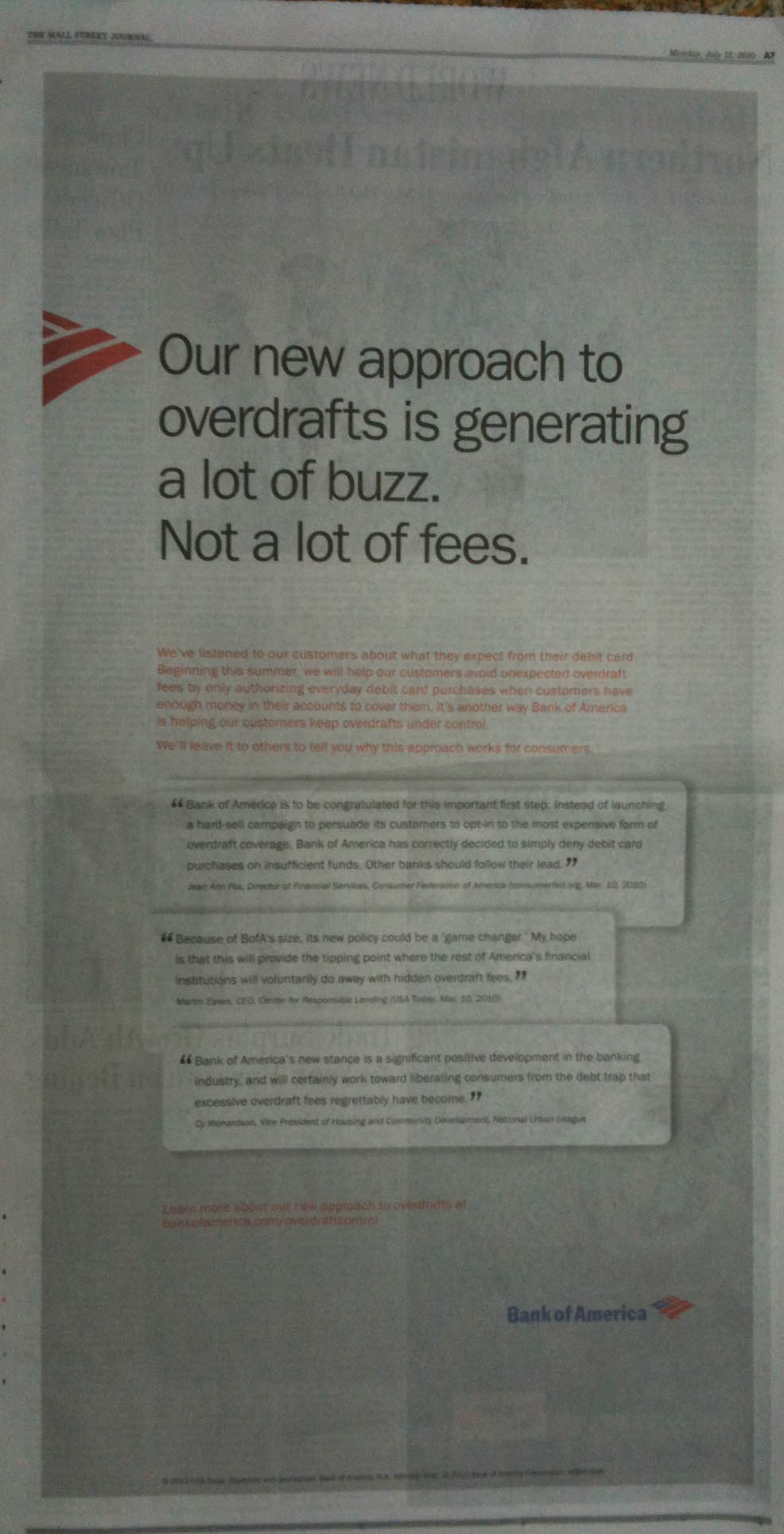

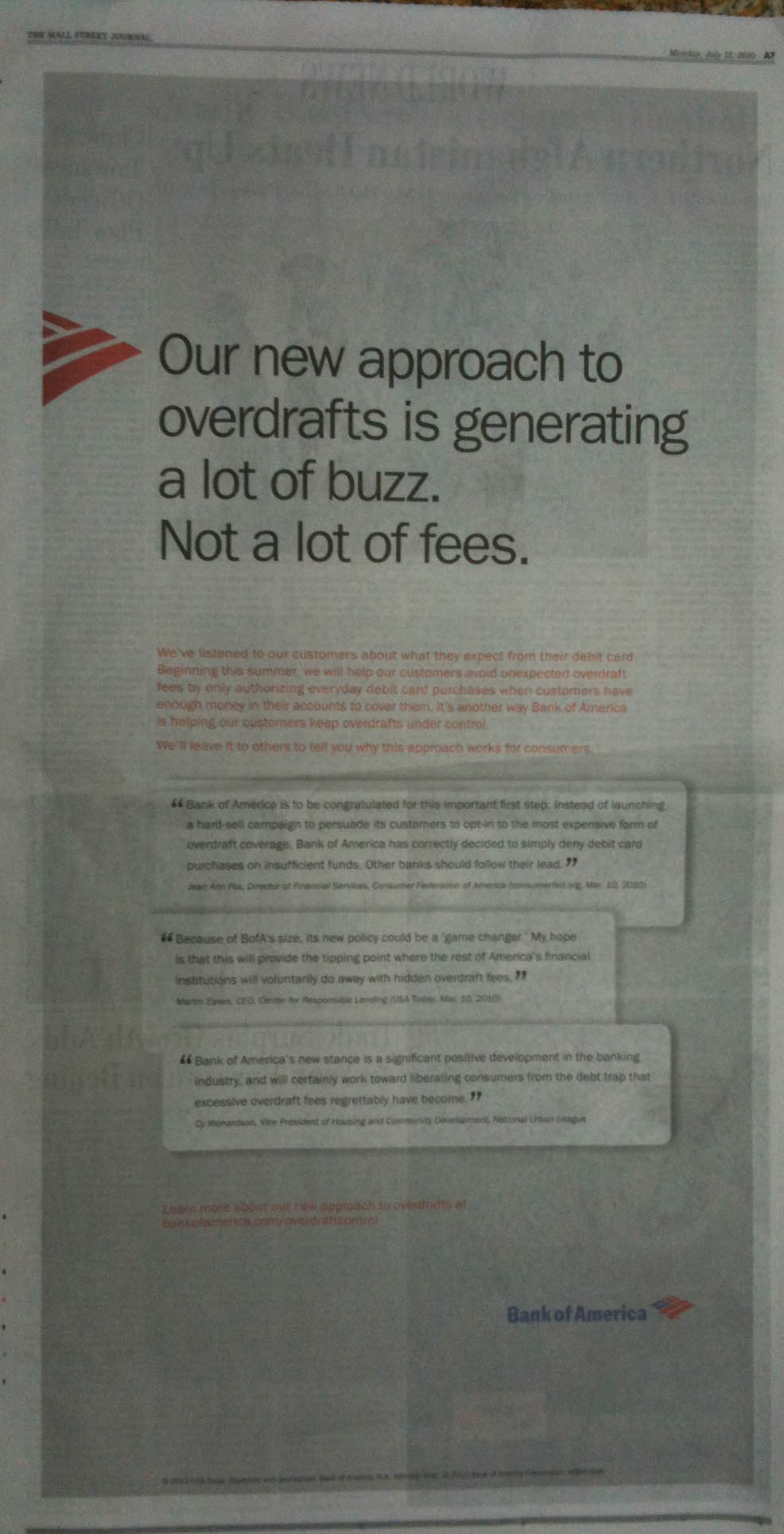

Bank of America is touting its new consumer friendly debit card overdraft policy in a full page Wall Street Journal ad in this mornings paper.

Bank of America decided that doing away with debit card overdraft “protection” was in the best interest of its customers, as most people expect debit cards to stop working once an account is out of money. One danger with debit cards that work as credit cards is that you grab the wrong card to make a big purchase. This wouldn’t make you inept at managing your account, just human. A mistake like that is likely to happen to everyone at least once in their lifetime.

Our new approach to overdrafts is getting a lot of buzz. Not a lot of fees.

We’ve listened to our customers about what they expect from their debit card. Beginning this Summer, we will help our customers avoid unexpected overdraft fees by only authorizing everyday debit card purchases when customers have enough money in their accounts to cover them. It’s another way Bank of America is helping customers keep overdrafts under control.

“Bank of America is to be congratulated for this important first step. Instead of launching a hard-sell campaign to persuade customers to opt-in to the most expensive form of overdraft coverage, Bank of America has correctly decided to simply deny debit card purchases on insufficient funds. Other banks should follow their lead.” – Jean Ann Fox, Director of Financial Services, Consumer Federation of America

There are a couple more quotes in the ad which I have left out as the first quote correctly captures the spirit of the ad; they are calling out other banks, especially Chase, which has been accused of fear-mongering tactics to get people to sign up for overdraft protection once they can’t offer it by default.

This story is so incredible it is just believable.

A customer, who got into a argument with a Chase branch manager went over her head and apparently pissed her off, because a couple of days later he found a $10 million debit on his account. It seems the branch manager was determined to make sure he wouldn’t have the benefit of his own money over the 4th of July weekend.

American’s credit scores have sunk to a new low.

NEW YORK – The credit scores of millions more Americans are sinking to new lows.

Figures provided by FICO show that 25.5% of consumers – nearly 43.4 million people – now have a credit score of 599 or below, marking them as poor risks for lenders. It’s unlikely they will be able to get credit cards, auto loans or mortgages under the tighter lending standards banks now use.

Because consumers relied so heavily on debt to fuel their spending in recent years, their restricted access to credit is one reason for the slow economic recovery.

Read more …

Perhaps lost in this article is the fact that many people’s credit scores are in fact lower because banks like Chase have gone and significantly reduced credit lines, with no reasoning, explanation, or notification. A reduction in a credit line to the outstanding balance creates a high credit limit to loan balance ratio which is bad for credit scores.

The fact that Chase doesn’t notify customers when it does this also makes it very likely that someone will use their credit card and go over their newly lower limit, thus incurring an over-limit fee. Thanks Chase.

Treasury Secretary Timothy Geithner was on The News Hour the other night and was asked about the dismal results for successful loan modifications. Apparently, there are $73 Billion in available funds and only a few hundred million have been spent on HAMP loan modifications to date. I wasn’t aware it was that bad. Pretty pathetic.

Well, things might be about to change for the better according to this article:

July 8, 2010 – Borrowers who have not been having any luck trying to get a loan modification with their mortgage holder will be happy to know about the recently initiated loan modification process.

Due to the low percentage of permanent modifications that are being offered the Treasury Department is now offering struggling homeowners a streamlined procedure with less paperwork and a short turnaround time.

Until recently the success rate of the Home Affordable Modification Program (HAMP) was rather dismal. Over $73 billion dollars that was accessible to fund HAMP was not being used to help homeowners who were facing foreclosure.

However, as of the beginning of this quarter new timelines and guidelines kicked in. It’s hoped that these changes will, at the least, let homeowners know whether they qualify for HAMP is a more reasonable amount of time.

It is now possible to get an answer to a loan modification application within thirty days.

If approved, it will be possible for borrowers who find it difficult to make their existing monthly payments, or those who will probably be delinquent in the foreseeable future, to reduce their net payable monthly payments or increase their mortgage tenure and get a more affordable mortgage loan repayment plan.

A search of the Internet will help those in need discover what the home affordable modification guidelines are – the ones that they need to know in order to qualify for HAMP.

So, it is now possible to get an answer within 30 days. Will those answers mostly be no? Will Chase all-of-a-sudden stop losing paperwork?

As reported today in Bloomberg BusinessWeek, entrepreneuer Josh Reich is moving ahead with his BankSimple idea, which is meant to be an antidote to big banks like Chase and will have features like

- No branches (yes, this is a feature)

- Access to a large network of ATM’s

- Smartphone optimized access

- No overdraft fees

- Earn interest at above average rates

- Smartphone notification system for debit transactions – you get notified of every transaction so you will know the second fraud occurs

The motto for BankSimple is “BankSimple isn’t bank becasue banks suck.”

The plan is to begin serving an initial 10,000 customers this Fall.

Dear Chase,

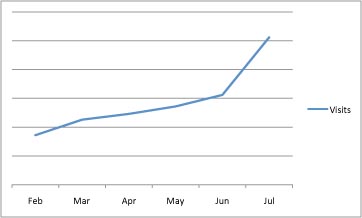

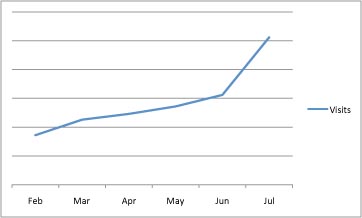

A lot has happened in the last six months and we figured it is about time we wrote you a note to let you know what is going on. Take a look at the number of daily visits our little site has been getting over the last six months:

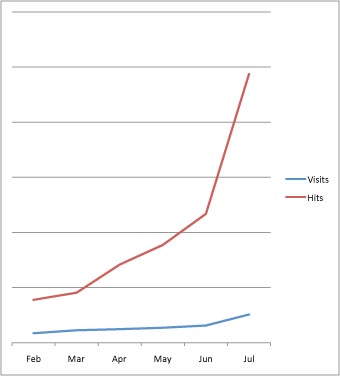

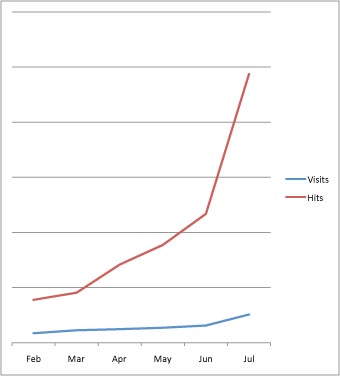

What you see is that the number of people visiting our site has tripled in that time period. Now compare that with the number of hits (i.e. how much people are actually looking at when they visit).

What you are seeing is that not only is the number of people visiting our site growing very fast, but the amount of information they are looking at is growing even faster. The average person is reading almost 10 stories when they visit, stories about Chase that are not very flattering.

Now, we know people that work for you are visiting us, and we have a very strong feeling that you’ve been losing customers recently. We hope you will take the convenient opportunity of having all the negative things people are thinking and saying about your bank all in one place and start using that information to improve the way you do business and the way you treat customers. That has been our goal from the start.

Thanks for listening and there is no need to reply. When the number of visits we see from your banks networks increases substantially, we’ll know that you are reading everything and taking the information to heart.

Sincerely,

Your friends at Chase-Sucks.org

I have no idea how I missed this little story a few months ago, but some pissed off Chase customer left them a present in the form of a pile of manure in an ATM vestibule.