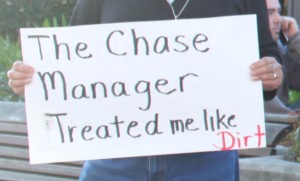

Here come the foreclosure fraud class action lawsuits

If your counting the number of class action lawsuits filed against Chase for fraud in filing false documents related to foreclosures, scratch a couple of marks into your bed post; two new class action lawsuits were filed this week.

Nov 10 2010. JP Morgan Chase bank’s foreclosure fraud process.

In a regulatory filing submitted yesterday, November 9, JPMorgan Chase & Co. acknowledged that two separate class action lawsuits have been filed against their company, alleging fraud related to its decision to temporarily stop foreclosure proceedings.

Two months ago, Chase had placed a moratorium on foreclosure proceedings, while it launched an internal investigation into the possibility of discrepancies in its foreclosure documents.

Last week, Chase announced it would start refilling foreclosure documents within a few weeks.

One of the class action lawsuits was filed in the US District Court for the Northern District of Illinois, charging Washington Mutual Bank and JPMorgan Chase & Co. with knowingly filing false documentation.

A separate suit against Chase Home Finance was filed in California state court as well.

JPMorgan also acknowledged a class action lawsuit filed on behalf of Charles Schwab and Cambridge Place Investment Management, a hedge fund company. That suit was related to mortgage backed securities sold to the investors with the demand that the bank buy back the securities due to their faulty foreclosure documents.

Bank of America and Citigroup had already disclosed that similar suits were filed against them as well.

In both class action lawsuits, they allege “common law fraud and misrepresentation, as well as violations of state consumer fraud statutes.”

No dates have been announced as to when the proceedings will begin.

While JPMorgan has fared better on Wall Street than most of its competitors, consumer confidence is definitely fading, as shares in the bank dropped 0.3% in early trading on Tuesday.