AUBURN, Wash. – Buying his own home was a big accomplishment for construction worker, Ikenna Njoku, of Auburn. He’s only 28 years old.

“I was really excited. For the first time, I actually got to buy a lawn mower, mow my lawn and everything,” said Njoku.

Njoku qualified for the first time home buyer rebate on his tax return.

“It was really important, I had a vehicle I was looking on paying off,” said. Njoku. And it wasn’t just any vehicle. “It was a 2001 Infinity I-30, silver…just like my favorite car, “he said.

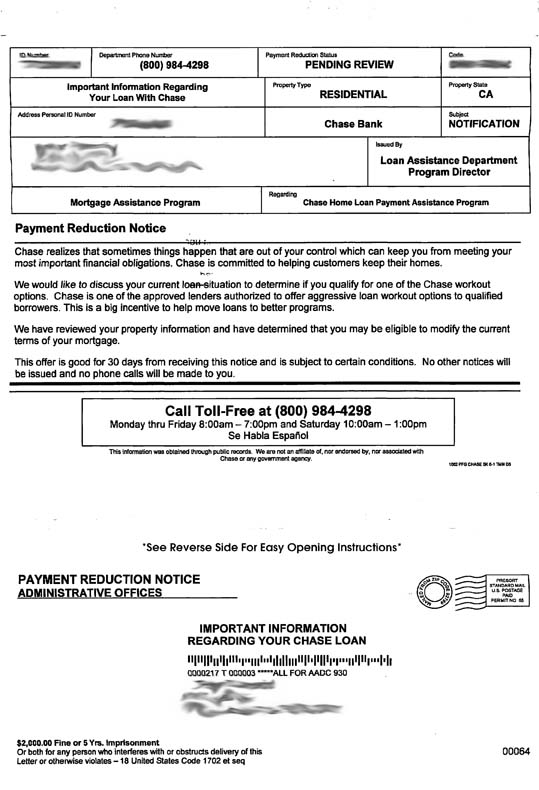

Njoku signed up to have the rebate deposited directly into his Chase Bank account. But when the IRS rebate arrived, there was a problem. Chase had closed Njoku’s account because of overdrawn checks in the past. The bank deducted $600 to cover what he owed them and mailed him a cashier’s check for the difference–$8,463.21.

But when Njoku showed up at the Chase branch near his house intending to cash the check, he was in for a nasty surprise.

The check had Njoku’s name and address on it and was issued by JP Morgan Chase. But the Chase Customer Banker who handles large checks at the Auburn branch was immediately suspicious.

“I was embarrassed,” Njoku said. “She asked me what I did for a living. Asked me where I got the check from, looked me up and down—like ‘you just bought a house in Auburn, really?’ She didn’t believe that,” he said.

The Customer Banker said the check looked fake, so she took it, along with Njoku’s driver license and credit card, and called Bank Support.

After waiting for about 15 minutes, Njoku said he got impatient and told Chase he was leaving to do an important errand. By the time he got back, the bank was closed. Njoku said he called customer service and asked them what he should do. He says they told him to go back to the bank the next day to get his money.

But when Njoku arrived, it wasn’t the money that was waiting for him.

“They just threw me in jail; they called the police and said this guy has a fraudulent check,” Njoku said.

Auburn police arrested him for forgery – a felony crime.

“I was like – you’re making a mistake, you’re making a mistake, don’t take me to jail, I got work tomorrow. I can’t afford to miss work,” he said.

Njoku was taken to jail on June 24, 2010, which was a Thursday. The next day, Chase Special Investigations, realized it was a mistake. The check was legitimate. The Investigator called Auburn Police and left a message with the detective handling the case, but it was her day off. So Njoku stayed in jail for the entire weekend. Finally, on Monday, he was released.

Auburn Police Commander Dave Colglazier said Chase could have done a lot more to let them know they’d locked up an innocent man.

“We do have a main line that comes into our front office,” he said. “There are ways to reach someone 24/7 at a police department.”

For Njoku, going to jail for five days meant a lot more than just losing his freedom. He said the entire time he was “just stressed out…trying to figure out what was going on with my vehicle. I love my vehicle,” he said.

Njoku’s car had been towed from the bank parking lot and his check seized as evidence.

“I had to wait a couple of weeks,” he said, “and my car got sold, auctioned off.”

Njoku says he didn’t have the money to pay the impound fees and fines to get his car back before it was sold. He said he also lost his job because he didn’t show up for work while he was in jail.

After all of that, Njoku said he never heard a word from Chase.

“They haven’t even sent me a letter or apologized,” he said. “It’s been a year we’ve been trying to contact these guys.”

“It’s one thing to make a mistake,” Luna said. “It’s one thing to make multiple errors of judgment like Chase has made and then, once you realize that your error has caused such harm to somebody else, to just ignore it for a year. I think he deserved better. I think all their customers do.”

Like Njoku, KING 5 had a difficult time getting answers from Chase. A week after first contacting them, they sent a two line e-mail.

“We received the letter and are reviewing the situation. We’ll be reaching out to the customer,” wrote Darcy Donoahoe-Wilmot, from Chase Media Relations.

Njoku said that even after he got out of jail, he said was confused and upset. “For a month, two months, I was just down and depressed,” he said.

He’s still happy he bought his house, but sad that his experience with his own bank was so humiliating.

“They treated me like a criminal,” he said.